Manufacturers Attack CBN, Accuses Apex Bank Of Prioritising Financial Sector Over Real Sector

This post has already been read 2372 times!

Nigerians in the manufacturing sector have accused the Central Bank of Nigeria (CBN) of prioritising the financial sector over the real sector in the manner it has been deploying its monetary policy options.

Citizens in the sector under the aegis of the Manufacturers Association of Nigeria (MAN) expressed this view in a press statement titled the “Position of MAN on the Report of Monetary Policy Committee Meeting on May 20-21, 2024.”

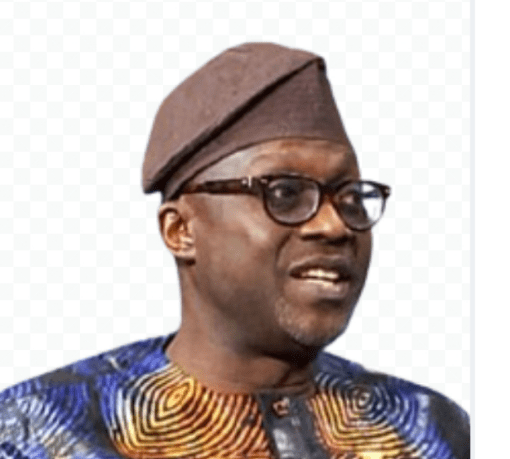

The Director General of MAN, Mr. Segun Ajayi-Kadir, who issued the statement on Thursday noted clearly that “It is evident that the Monetary Policy Committee (MPC) leans towards prioritising the financial sector over the real sector, rather than striving for a balanced approach between the two.”

Recall that the MPC recently reached a decision to raise the interest rate by 150 basis points, from 24.75 percent to 26.25 percent and opted to maintain the Cash Reserve Ratio (CRR) of deposit money banks at 45.0 percent and retain the liquidity ratio at 30.0 percent during its latest meeting.

“Furthermore, recent decisions by the MPC exacerbate these challenges by further tightening credit interventions, increasing loan costs, raising production cost, limiting fund accessibility, and eroding investment and competitiveness within the manufacturing sector,” he said.

The director general of MAN noted that the strategy of raising the MPR has persisted for nearly two years without yielding positive results.

Ajayi-Kadir stated that the probable outcomes that could be harvested from continued tightening of monetary instruments would be constraints on investment, business expansion and further decline in manufacturing competitiveness.

He said: “The combination of heightened borrowing costs and reduced liquidity will hinder manufacturers’ ability to invest in innovative technologies, expand production capacities, or venture into new markets.

“As a result, this could lead to delays or cancellations of planned initiatives, ultimately constraining the sector’s potential for growth and its overall contribution to economic growth and development.”

He, therefore, said that the CBN should explore alternative measures, particularly in addressing the underlying causes of inflation, primarily cost-push factors.

He said: “MAN, earnestly urges the MPC to carefully evaluate the effects of these monetary policy actions on both the manufacturing sector and the broader economy.

“Achieving a delicate equilibrium between addressing macroeconomic challenges and fostering the growth and resilience of the manufacturing industry is crucial.

He also emphasised the development of infrastructure within industrial hubs and bolstering nationwide investments in renewable energy sources to alleviate logistical expenses and enhance competitiveness.

Furthermore, he called for the reduction of the reliance of the country on imported products and raw materials by providing incentives for investment in backward integration and local sourcing to reduce the pressure on the dollar to the barest minimum.

Discover more from Abuja Business Reports Newspaper & Magazine

Subscribe to get the latest posts to your email.