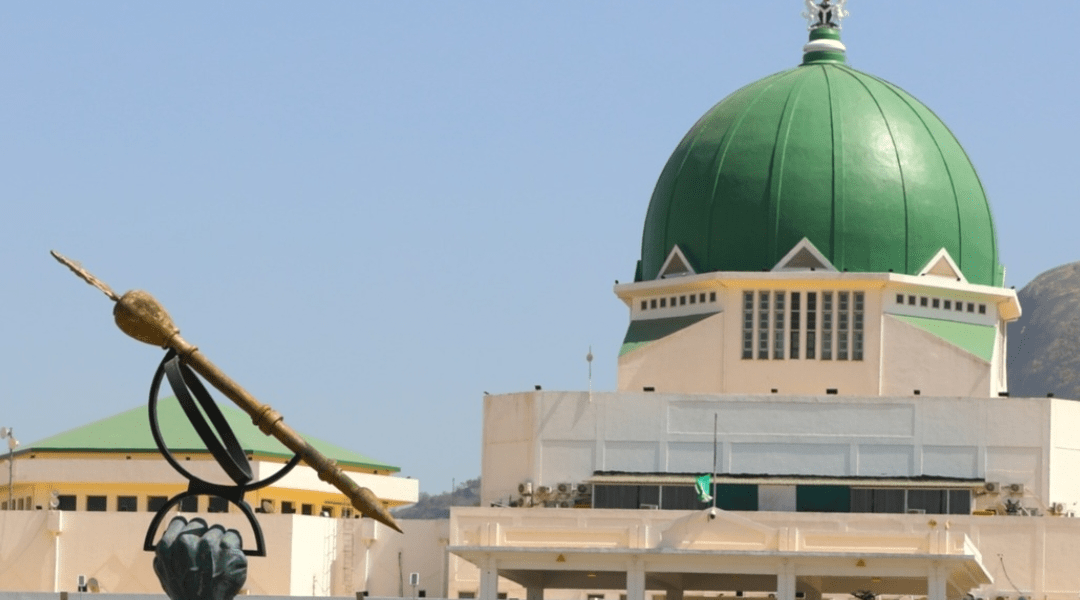

Controversy Continues to Trail Nigeria’s Tax Reforms Bill As it Scales 2nd Reading in Senate Amidst Reps’ Resistance

This post has already been read 22002 times!

Nigeria’s Tax Reforms Bill has continued to spark intense controversy as it passed the second reading at the Senate, while the House of Representatives resisted its progression. The executive bill, forwarded by President Bola Tinubu in October 2024, aims to overhaul the country’s tax system, simplify the tax landscape, and reduce the burden on small businesses.

According to Senate Leader Opeyemi Bamidele, “The Nigerian tax reforms bill is a significant move to overhaul the country’s tax system… These bills aim to simplify the tax landscape, reduce the burden on small businesses, and streamline how taxes are collected.”

Bamidele also highlighted the proposal to exempt those earning minimum wage from PAYE deductions and small businesses with an annual turnover of N50,000,000 or less from payment of taxes.

However, not all lawmakers are in support of the bill. Senator Ali Ndume expressed concerns about the timing and issues surrounding derivation and VAT, stating, “Generally, the bill is good, but I have issues with the timing and most importantly issues surrounding derivation and VAT”.

Meanwhile, the House of Representatives witnessed a chaotic session as lawmakers resisted the planned second reading of the tax reform bills. Deputy Speaker Benjamin Okezie Kalu described the atmosphere as “heated,” with many lawmakers accusing the leadership of failing to address critical flaws in the bills.

Lawmaker Zubairu Bashir Usman emphasized the need for careful scrutiny of the bills, stating, “There is a lacuna in these bills that must be addressed… I’m not an accountant or economist, so I need to study them properly to understand their impact on my constituents”.

As the controversy surrounding the Tax Reforms Bill continues to unfold, it remains to be seen whether the bill will eventually become law. One thing is certain, however: the fate of Nigeria’s tax system hangs in the balance.